#1 Hiring Tax Credit Platform

Our Trusted Partners

The Problem

Most Companies Lose Thousands in Tax Credits, Without Realizing It.

With Canary AI Avoid the Retention Danger Zone.

Keeping new hires past 90 days helps you avoid costly turnover and lock-in hiring tax credits like WOTC.

of new hires quit within 90 days, costing businesses productivity, money and the tax credits attached to those hires.

Even a small improvement in retention can mean tens of thousands of dollars in recovered credits every year.

Up to $2,400 - $9,600 PER Employee in annual tax credits could be yours if you retain enough of your qualifying employees

Our Solution

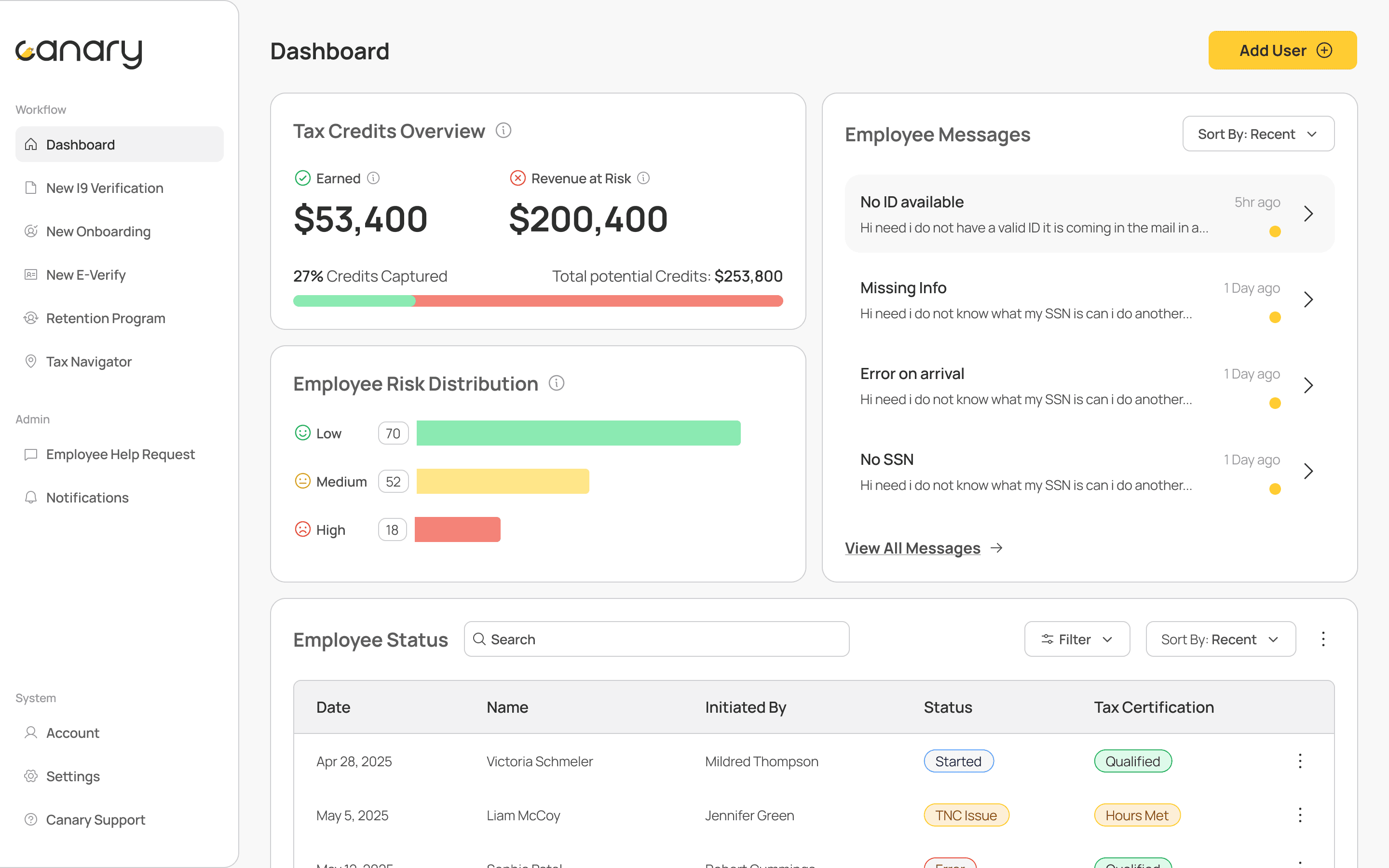

All Your Hiring, Compliance, and Credits—In One Smart Platform.

Canary combines AI-powered analytics, tax credit automation, and digital onboarding to make hiring more efficient and more profitable.

Ready to turn hiring into savings?

Delivering Value

Delivering Value You Can Measure

Businesses nationwide use Canary to turn compliance into savings and new hires into long-term value. From manufacturing to retail, clients consistently see: Higher retention rates in the first 90 days, More tax credits captured automatically, and Simpler workflows with fewer HR errors

Why Canary

Why Businesses Choose Canary

One platform. Every hire. Real savings.

#1 Employee Retention Platform

Transform your workforce, simplify onboarding, and uncover thousands in hidden hiring credits.